The figures show a widening gap between houses compared to units, according to CoreLogic head of research Tim Lawless.

“The divergence in growth rates is the most distinct in Melbourne and Brisbane, where concerns around unit oversupply have eroded buyer confidence,” he said.

“Melbourne house values are up 15.1% over the year compared with a 1.7% rise in unit values, while Brisbane house values are 4.0% higher over the year, with unit values falling by -0.2%.”

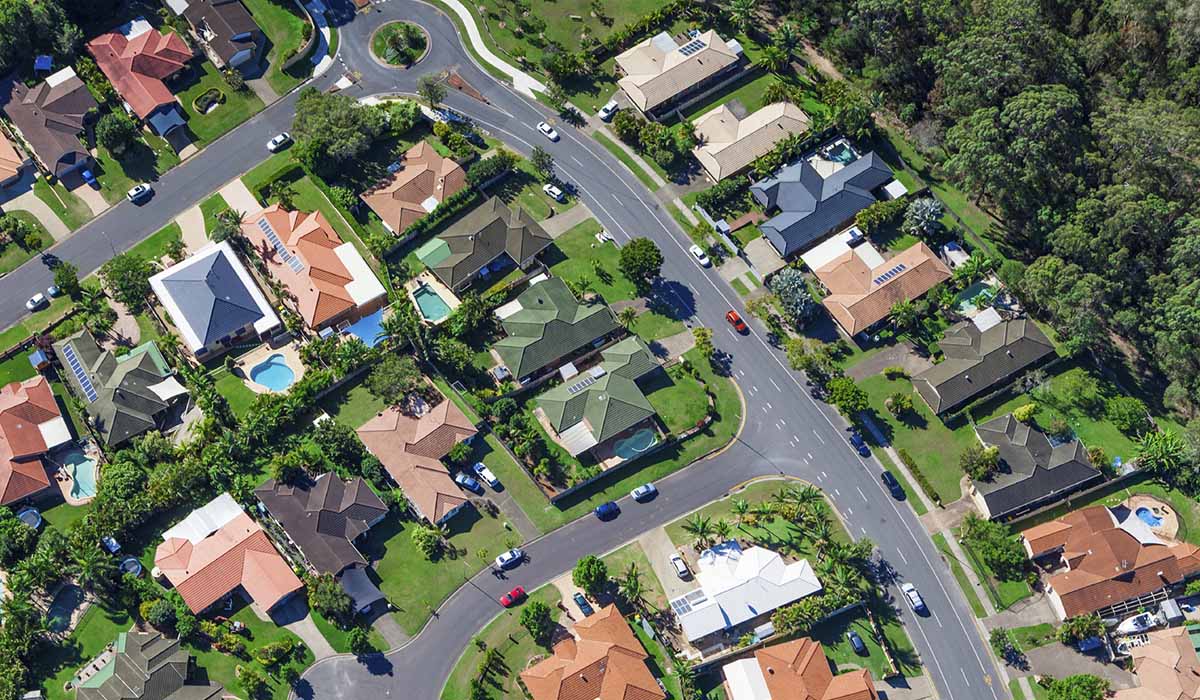

Looking at the median values of all dwellings, growth was evident in every Australian capital city except Perth which recorded a 4.3% decline in 2016.

Brisbane dwelling values finished the year up 3.6% while Sydney (15.5%) and Melbourne (13.7%) continued to lead the property pack.

That makes Brisbane an attractive proposition for investors while Sydney continues to turn up the pain dial when it comes to affordability.

“The recent CoreLogic Housing Affordability Report shows Sydney dwelling prices were 8.3 times higher than annual household incomes and households were dedicating an average of 44.5% of their income to service a mortgage (based on an 80% loan to valuation ratio and the average discounted variable mortgage rate),” reports CoreLogic.

Want to put your money in a market that won’t cost you an arm and a leg? View our current listings for sale.

Ready to cash in? Book a valuation or talk to us about selling.