Loans to owner occupiers and investors in Queensland recorded the strongest growth of all states over the past year, reports Property Update, citing recent research from Money.com.au.

This is a positive sign of strong, sustained demand.

“Queensland is again proving to be Australia’s property hotspot,” Property Update reports.

“Both owner-occupier and investor lending recorded the strongest growth among major states, supported by population growth, lifestyle appeal, and a resilient economy.

Crucially, this growth is broad-based.

“Every loan category, from construction to existing dwellings, is in positive territory. That suggests Queensland’s momentum isn’t a speculative bubble but reflects genuine, sustainable demand.”

Across Australia, loan volumes remain below the levels of borrowing seen before the post-pandemic rate hikes began. Owner-occupier loans are down almost 20 per cent compared to mid 2022, while investor loans are slightly lower than previous levels.

But the size of the loans are getting bigger, up 8 per cent over the past year, indicating that affordability remains a challenge, but demand is still strong.

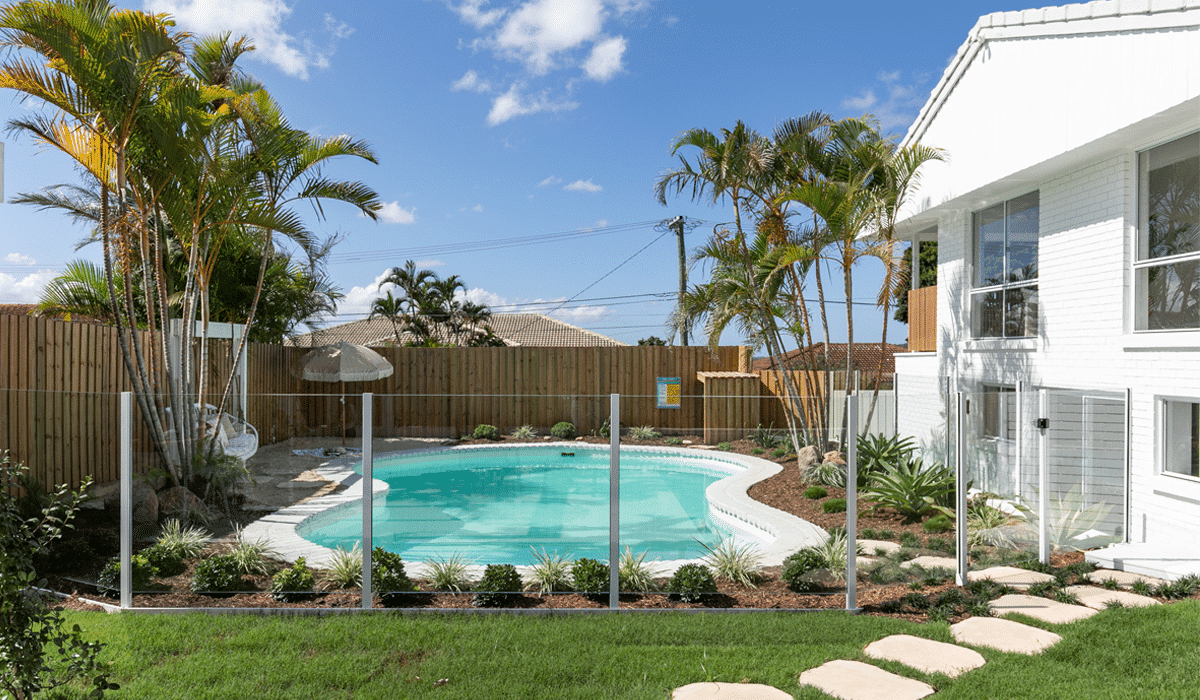

Ready to take your next step? View our current listings for sale or talk to us about selling.