Help in the form of lower interest rates and government policies have eased some of the barriers to home ownership for first timers.

For eligible applicants, banks have started to exclude HECS-HELP debts or reduce their consideration when assessing first home owner loan applications, reports Broker News.

The Labor government is offering 5 per cent deposits for first home buyers while avoiding lenders mortgage insurance under its First Home Guarantee.

The Queensland government has extended the boosted $30,000 First Home Owner Grant for new builds until 30 June 2026.

Happy days!

But competition from investors is still hot as they enter the market at a rate three times faster than owner occupiers overall, reports Smart Property Investor.

“Money.com.au’s general manager of lending, Jacob Overs, said investor confidence in the property market has been getting stronger as the Reserve Bank of Australia passes rate cuts, with 196,241 new investor loans in the 2025 March quarter just 3 per cent shy of the 2022 peak,” it reports.

So if you’re a first timer looking to get into the market be prepared to face some competition. Here are a few tips to set you up for success:

- Get independent financial advice to help you set a budget and stick to it.

- Get home loan pre-approval.

- Research state and federal government support for first home buyers – a good, independent mortgage broker can help you with this.

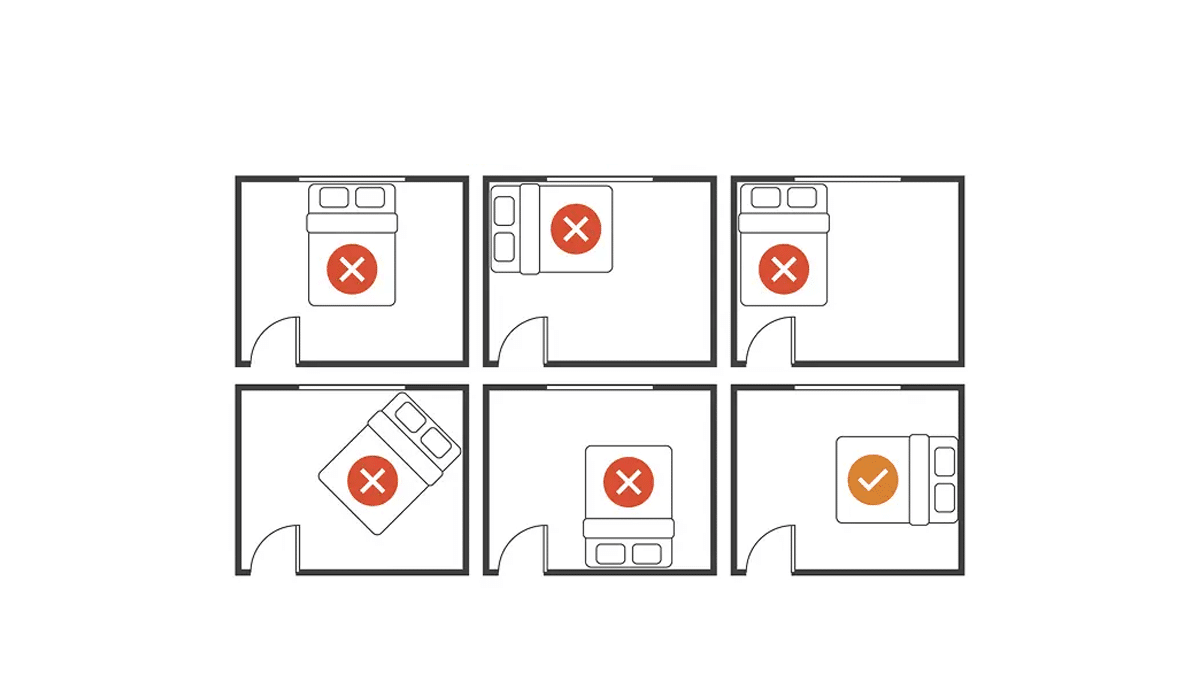

- Research areas you can afford to buy and be clear on what you can compromise on.

- Connect with local agents to stay across new listings as they come to market.

Ready to buy? Contact us for a chat about anything real estate.