But for those who are thinking about investing or wanting to check your accountant is on their game, you might find it helpful to read more about some common investment property deductions you can claim in your tax return. Ready? Take note:

- You can claim your borrowing costs when you buy an investment property, such as loan establishment fees and lenders’ mortgage insurance. But purchasing costs such as conveyancing and stamp duty are not deductible, says AusTax.

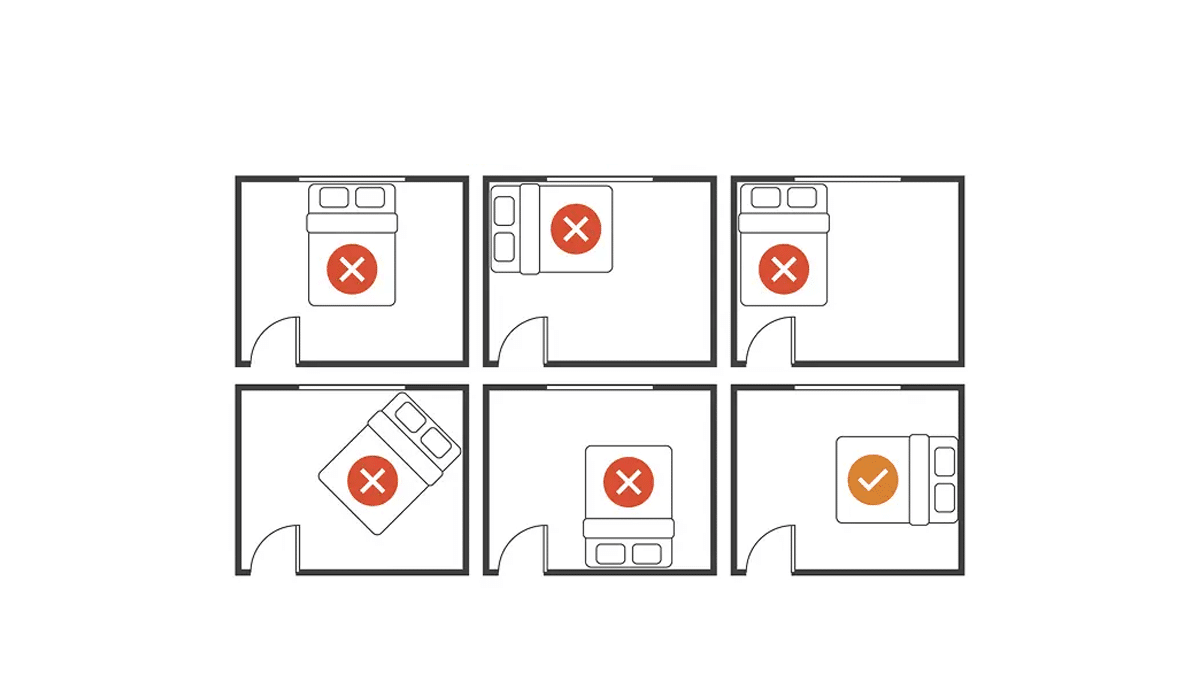

- If you don’t have a depreciation schedule, phone a quantity surveyor and get one drawn up before you do your tax. What’s a depreciation schedule? It means you can claim tax back for wear and tear on your property structure, fixtures and fittings. New builds will offer particularly big depreciation opportunities. Read more on the ATO website.

- You can claim interest on investment loans. But be careful if you withdraw amounts from offset or redraw for non-investment purposes. This can reduce the amount of tax deductibility.

- You can deduct repair costs, which means you can claim the full amount of repair expenses in the tax year in which you incurred them.

- Improvements, however, such as adding a back deck or renovating a kitchen, must be depreciated over several years. Refer above to the need for a depreciation schedule.

Looking to invest? View our current listings for sale and talk to us about landlording.